Time to Act on Health Care Costs

Near-term changes to the consumer and provider sides of health care financing are essential to prevent the nation from being overwhelmed by rapidly rising health care expenditures.

Popular discussions of the long-term fiscal challenges confronting the United States usually misdiagnose the problem. They typically focus on the government expenses related to the aging of the baby boomers, with lower fertility rates and longer life expectancy causing most of the long-term budget problem. In fact, most of the long-term problem will be driven by excess health care cost growth; that is, the rate at which health care costs grow compared to income per capita. In other words, it is the rising cost per beneficiary rather than the number of beneficiaries that explains the bulk of the nation’s long-term fiscal problem.

One can see this phenomenon manifesting itself even in the next decade: Figure 1 shows the Congressional Budget Office’s (CBO’s) projections for spending on Social Security, Medicare, and Medicaid through 2017. As Figure 1 shows, Social Security rises by about 0.5% of gross domestic product (GDP), from 4.2 to 4.8%, over that period. Spending on Medicare and the federal share of Medicaid rises from 4.6 to 5.9% of GDP—an increase of 1.3%, or roughly twice as much as that for Social Security.

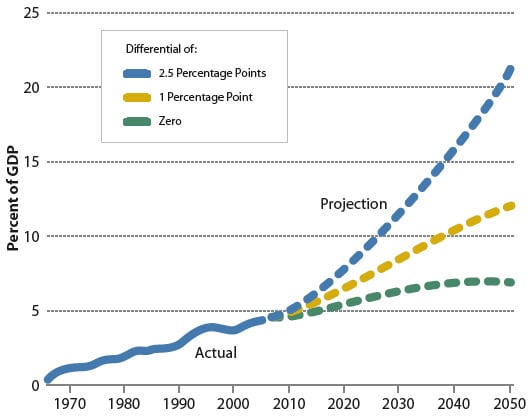

If one looks further into the future, the basic point is accentuated. Figure 2 portrays a simple extrapolation in which Medicare and Medicaid costs continue to grow at the same rate over the next four decades as they did over the past four decades. (Fortunately, even with no change in federal policy, there are reasons to believe that this simple extrapolation overstates future cost growth in Medicare and Medicaid. The CBO has recently released a long-term health outlook that presents a more sophisticated approach to projecting Medicare and Medicaid costs under current law, but this simple extrapolation is adequate to illustrate the key point.) Under this scenario, Medicare and Medicaid would rise from 4.6% of the economy today to 20% of the economy by 2050. To appreciate the scale of this increase, all of the activities of the federal government today make up 20% of the economy.

FIGURE 1

Spending on Medicare and Medicaid and on Social Security as a percentage of GDP, 2007 and 2017

The most interesting part of Figure 2 is the bottom line, which isolates the pure effect of demographics on those two programs. The only reason that the bottom line is rising is that the population is getting older and there are more beneficiaries of the two public programs. The increase between today and 2050 in that bottom dotted line shows that aging does indeed affect the federal government’s fiscal position. But that increase is much smaller than the difference in 2050 between the bottom line and the top line. In other words, the rate at which health care costs grow—whether they continue to grow 2.5% per year faster than income per capita, or 1%, or 0.5%—is to a first approximation the central long-term fiscal challenge facing the United States.

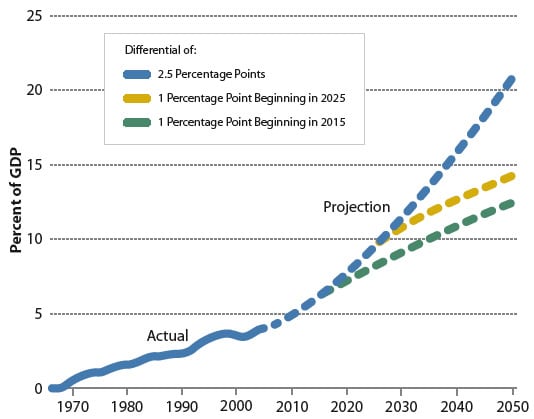

Conventional wisdom tells us that the sooner we act, the better off we are, and convention certainly has it right in this case. Figure 3 shows that if we slow health care costs’ excess growth from 2.5 to 1% per year starting in 2015 (which would be extremely difficult if not impossible to do, but is helpful as an illustration), the result in 2050 would be that federal Medicare and Medicaid expenditures would account for 10% rather than 20% of GDP.

On its face, this challenge looks pretty daunting. And it is further complicated by the fact that it is implausible that we will slow Medicare and Medicaid growth unless overall health care spending also slows. The reason is that if all one did was, say, reduce payment rates under Medicare and Medicaid, and then tried to perpetuate that over time without a slowing of overall health care cost growth, the result would probably be that fewer doctors would accept Medicare and Medicaid patients, creating an access problem that would be inconsistent with the underlying premise and public understanding of these programs. One therefore needs to think about changes in Medicare and Medicaid in terms of the impact that they can have on the overall health care system.

FIGURE 2

Total federal spending for Medicare and Medicaid under assumptions about the health cost growth differential

From that perspective, this long-term fiscal challenge appears to present a very substantial opportunity: the possibility of taking costs out of the system without harming health. Perhaps the most compelling evidence underscoring this opportunity is the significant variations across different parts of the United States that do not translate into differences in health quality or health outcomes, as explained by Elliott Fisher in the accompanying article.

The question then becomes, why is this happening? To me, it appears to be a combination of two things. One is the lack of information specifically about what works and what doesn’t. And the second thing is a payment system that gives neither providers nor consumers an effective incentive to eliminate low-value or negative-value care.

On the consumer side, and despite media portrayals to the contrary, the share of health care expenditures paid out of pocket, which is the relevant factor for evaluating the degree to which consumers are faced with cost sharing, has plummeted over the past few decades, from about 33% in 1975 to 15% today. All available evidence suggests that lower cost sharing increases health care spending overall. The result is that collectively we all pay a higher burden, although the evidence is somewhat mixed on the precise magnitude of the effect.

This observation leads some analysts to argue that the way forward is more cost sharing and a health savings account approach, and that can indeed help to reduce costs. But there are two things that need to be kept in mind in evaluating this approach. The first is that there is a significant amount of cost sharing that is involved in existing plans. Moving to universal health savings accounts would thus not entail as much of an increase in cost sharing, and therefore as much of a reduction in spending, as one might think. Second, there is an inherent limit to what we should expect from increased consumer cost sharing, because health care costs are so concentrated among the very sick. For example, the top 25% most expensive Medicare beneficiaries account for 85% of total costs, and the concentration of health care costs among a small share of the population is replicated in Medicaid and in the private health care system. To the extent that we in the United States want to provide insurance, and insurance is supposed to provide coverage against catastrophic costs, the fact that those catastrophic costs are accounting for such a large share of overall costs imposes an inherent limit on the traction that one can obtain from increased consumer cost sharing. In sum, increased cost sharing on the consumer side can help to reduce costs, but it seems very unlikely to capture the full potential to reduce costs without impairing health quality.

That leads us to the provider side, where the accumulation of additional information and changes in incentives would be beneficial. There is growing interest in comparative effectiveness research, and the original House version of the State Children’s Health Insurance Program legislation had some additional funding for comparative effectiveness research. Policymaker interest in expanding comparative effectiveness research is encouraging, but we need to ask some hard questions about what we mean by comparative effectiveness research and how it would be implemented.

The first issue is what kind of research is undertaken and what standard of evidence is used. As Mark McClellan, the former administrator of the Centers for Medicare and Medicaid Services, has noted, comparative effectiveness research will very probably have to rely on nonrandomized evidence. The reason is that it seems implausible that we could build out the evidence base across a whole variety of different clinical interventions and practice norms using randomized control trials, especially if we want to study subpopulations. On the other hand, economists have long been aware of the limitations of panel data econometrics, where one attempts to control for every possible factor that could influence the results and typically falls far short of perfection. There is thus a tension between using statistical techniques on panel data sets (of electronic health records, insurance claims, and other medical data), which seems to be the only cost-effective and feasible mechanism for significantly expanding the evidence base, and the inherent difficulty of separating correlation and causation in such an approach.

In terms of the budgetary effects from comparative effectiveness research, much depends on both what is done and how it is implemented. If the effort involves only releasing the results of literature surveys, the effects would probably be relatively modest. If new research using registries or analysis of electronic health records is involved, there may be somewhat larger effects. The real traction, though, will come from building the results of that research into financial incentives for providers. In other words, if we move from a “fee-for-service” to a “fee-for-value” system, where higher-value care is awarded with stronger financial incentives and low- or negative-value health care is penalized with smaller incentives or perhaps even penalties, the effects would be maximized. The design of such a system is very complicated and difficult to implement, but that is where the largest long-term budgetary savings could come.

My conclusion is that the combination of some increased cost sharing on the consumer side with a substantially expanded comparative effectiveness effort linked to changes in the incentive system for providers offers the nation the most auspicious approach to capturing the apparent opportunity to reduce health care costs with minimal or no adverse consequences for health outcomes.